Form 16 is essentially a certificate issued by an employer validating the fact that TDS has been deducted and deposited with the authorities on behalf of the employee. Through this article, let us help you decode your Form 16.

- What is Form 16?

- Part A of Form 16

- Part B of Form 16

- Details required from Form 16 while filing your return

- Frequently Asked Questions

- Download Consumer Guide

- Upload Form 16 and File Income Tax Return

1. Form 16- Basics

Form 16 is a certificate issued by an employer evidencing the TDS which is deducted from your salary and deposited with the authorities. It contains the information you need to prepare and file your income tax return.

It is issued annually, on or before 15th June of the next year, it immediately follows the financial year in which tax is deducted. Form 16, essentially has two components to it- Part A and Part B. In case you lose your Form 16, a duplicate can be issued by your employer.

2. Part A of Form 16

This part of Form 16 is generated and downloaded through the TRACES portal, by the employer. Prior to issuing the certificate, it will be authenticated for the correctness of its contents by the employer. It is important to note that if you change your job in one financial year, every employer will issue a separate Part A of Form 16, for the period of employment.

Some of the components of Part A are:

a. Name and address of the employer

b. TAN & PAN of employer

c. PAN of the employee

d. Summary of tax deducted & deposited quarterly, which is certified by the employer

3. Part B of Form 16

Part B of Form 16 is an annexure to Part A. If you change your job in one financial year, then it is for you to decide if you would want Part B of the Form from both the employers or from the last employer.

Some of the components of Part B are:

a. Detailed breakup of salary

b. Deductions allowed under the income tax act (under chapter VIA)

c. Relief under section 89

4. Details required from Form 16 while filing your return

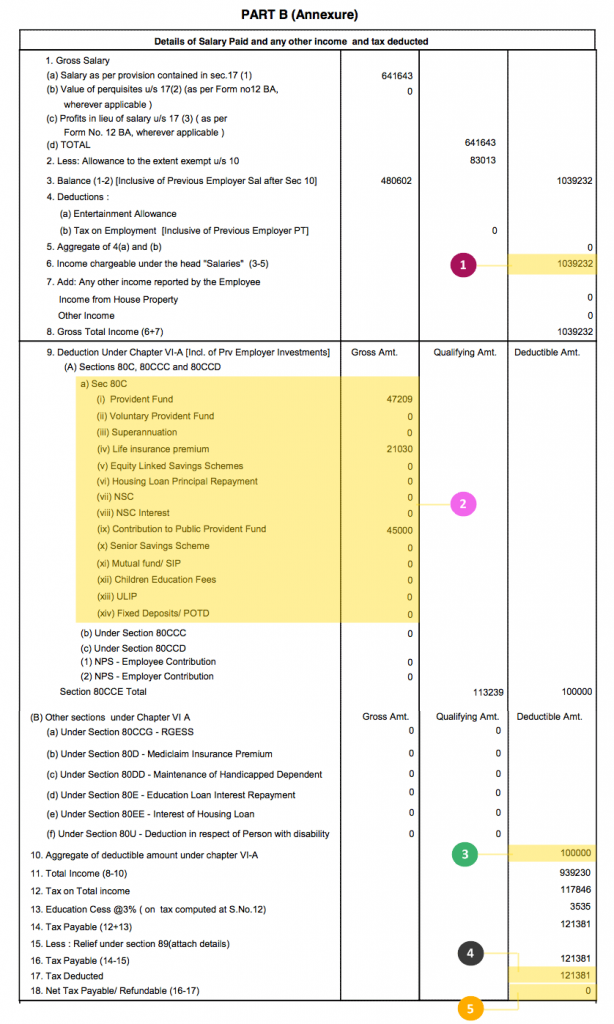

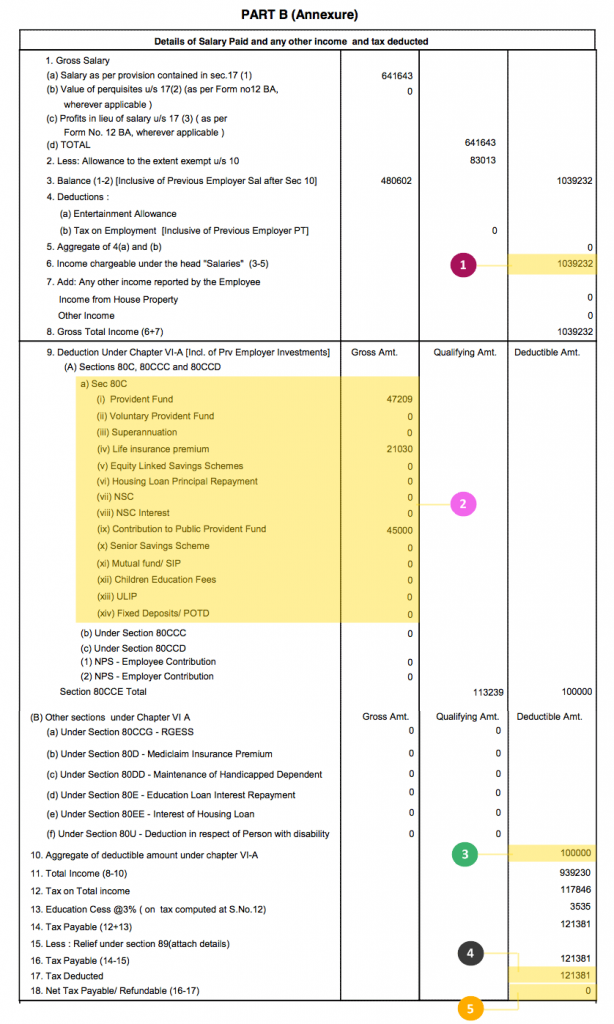

With reference to the image below, here is where you will be able to locate certain information for filing your annual return.

1. Taxable Salary

2. Breakup of Section 80C Deductions

3. Aggregate of Section 80C Deductions(Gross & Deductible Amount)

4. TDS (Tax Deducted at Source)

5. Tax Payable or Refund Due

Additional information, which you will require from your Form 16 while filing your annual return are:

a. TDS Deducted by Employer

b. TAN of Employer

c. PAN of Employer

d. Name and Address of Employer

e. Current Assessment Year

f. Your (Taxpayer’s) Name and Address

g. Your PAN

5. Frequently Asked Questions in Form 16

1. How to get Form 16?

a. You can get your Form 16 from your employer. Even if you have left your job, your employer will provide you the Form 16. Unfortunately, this income tax form 16, cannot be downloaded from anywhere.

2. I don’t have Form 16 how do I file my return?

Though this is one of the most important income tax forms, don’t worry if you do not have it. You can still file your income tax return. Click here to learn more.

3. If there is no TDS is the employer required to issue a Form 16?

TDS certificate in Form 16 is issued when TDS has been deducted. In case no TDS has been deducted by the employer, he may not give you a Form 16.

Take a look at our Guide on how to e-file without form 16

4. When the employer deducts TDS and does not issue a certificate?

Any person responsible for paying salaries is required to deduct TDS before making payment. The Income Tax Act lays down that every person who deducts TDS from a payment, must furnish a certificate with details of TDS deducted & deposited. An employer in specific is compulsorily required to furnish a certificate, in the format of Form 16.

5. If no Form 16 has been issued to me does it mean I don’t have to pay tax or file a return?

While the onus of deducting tax on salaries and providing Form 16 is on the employer, the onus of paying income tax and filing income tax return is on you. If your income from all sources is above the minimum tax slab you are required to pay tax, whether or not your employer deducted TDS. Even when he fails to issue you a Form 16, you must file an income tax return and pay off the taxes that are due.

the information you have updated is very good and useful, please update further.

ReplyDeleteif you require any info regarding TAX & GSTR please visit

Tax consultants in bangalore

Tax Return Filing in Bangalore

Love to read it,Waiting For More new Update and I Already Read your Recent Post its Great Thanks. can i efile a late tax return

ReplyDeleteWow..Amazing blog.. This blog is very helpful for me. Thanks for sharing this information with us.If you want to know more about Income Tax Consultants in delhi and Income Tax Returns Filing in delhi please click on it.

ReplyDelete